Your capitalization table is more than just numbers. It helps your business grow, hire, and get funds. This guide shows how to create a Startup Cap Table. It focuses on clean data, wise equity sharing, and a structure that grows with you.

You'll figure out founder equity, make vesting clear, and create an option pool for hiring. You'll also work on SAFEs and notes. Plus, you'll make a future cap table and see how investor shares might change. The aim is a cap table that impresses investors and helps your team move forward.

The method is straightforward: use standard terms, easy templates, and actions you can take now. We use tips from Y Combinator, Sequoia Capital, and Carta. This keeps your table on track with leading practices. See your cap table as a dashboard that guides your decisions about offers, funding rounds, and who owns what.

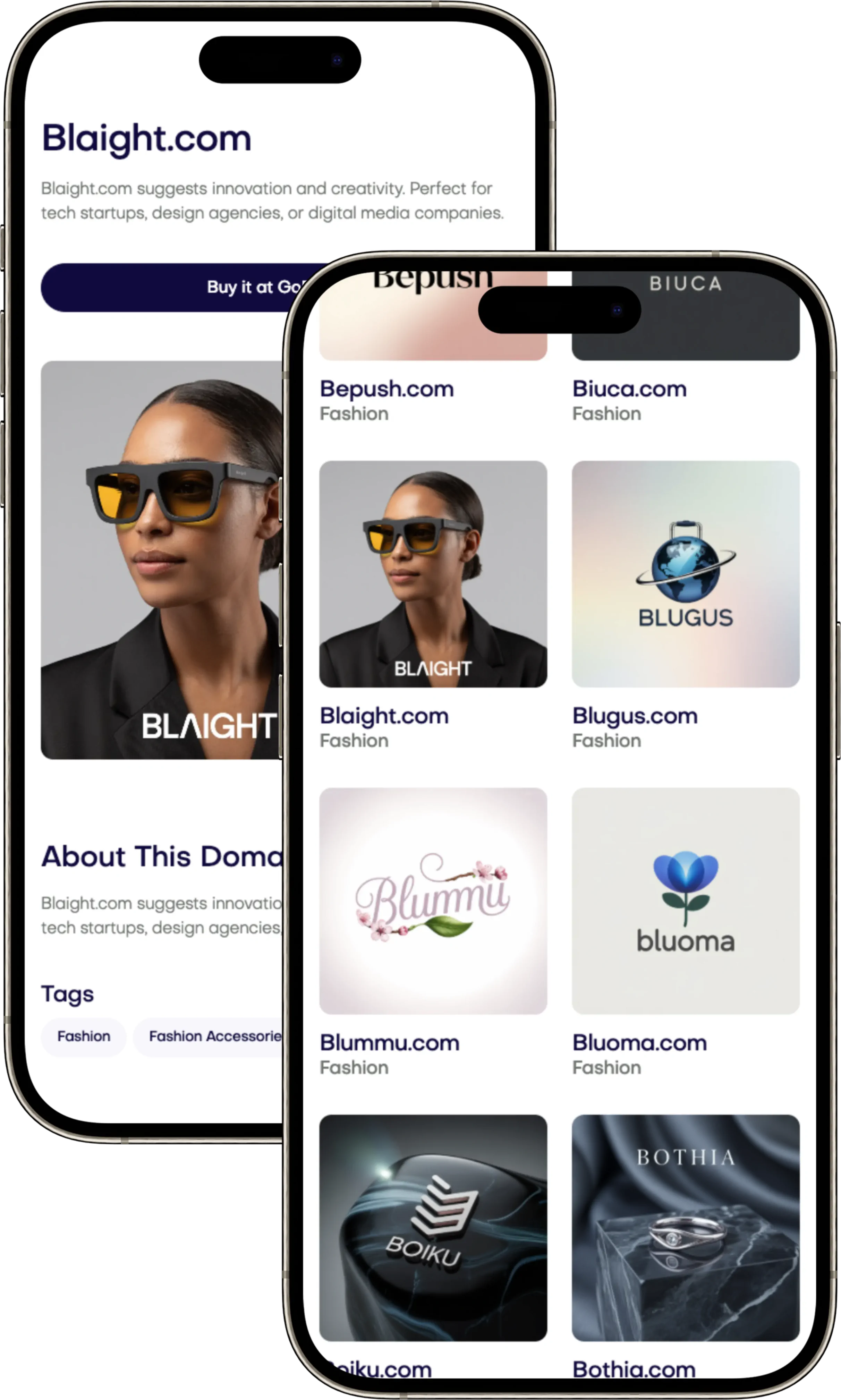

Keep your records accurate and share updates openly. Make your brand stronger with a fitting name. Find premium domain names at Brandtune.com.

What a Cap Table Is and Why It Matters for Early-Stage Companies

Your cap table is super important for your business. It shows who owns what in your company. It's where all shares, options, and other items are clearly listed. Knowing startup equity basics helps you make quick decisions about hiring, fundraising, and planning.

Defining capitalization tables in plain language

Imagine your cap table as the main record of who owns parts of your company. It lists everything—names, types of shares, how many shares, and percentages of ownership. This includes common and preferred shares, options, and more.

This detail helps you understand your company's current state. It makes tracking changes after fundraising rounds easy. So, you can see your company's growth clearly.

How ownership visualization supports smarter decisions

Tools like Carta and Pulley show you possible changes in ownership with visuals. You can see risks and how different decisions affect your company. This helps you make smart choices about offers to new hires and planning your budget.

With these tools, you can easily compare different fundraising scenarios. They make talking with investors smoother. And they help you tell your company's story without confusion.

Common pitfalls from poorly maintained equity records

Small errors in cap tables can lead to big problems. Examples include forgotten board approvals or not updated records. This makes things slow and confusing during financial checks. It can also make your company look bad.

Keep your records accurate by centralizing and checking them often. Include everything in your summaries. This way, your decisions are always based on correct data.

Core Components of a Clean Cap Table

A clean cap table includes every holder, type of share, and term in one spot. It should have a simple layout. It organizes by clear equity classes and shows all shares on a fully diluted basis. It's vital to use the same fields: holder name, type of share, number of shares, date given, how they vest, buy price, value at start, approval date, and document links.

Founders’ common shares

Record all the common shares from the start. Include how they vest and any buy-back rights. Mark any special conditions like change of control or firing that speeds up vesting. This ensures ownership is correct from the start and for future investments.

Employee option pool and reserved shares

Define the option pool as shares set aside for new hires and advisors. Track its size as part of all shares, with details like grant dates and prices. Keep a plan to see when more shares are needed and how it changes ownership.

Preferred shares from external investors

List each round of preferred shares, covering details like buy price and values before and after investment. Also include special rights and how they can change into common shares.

Convertible instruments and their placeholders

Set up placeholders for SAFEs and convertible notes that turn into preferred shares later. Note important terms like valuation caps and interest rates. Include these in the all-shares view to accurately show ownership before new investments.

Startup Cap Table

Start your Startup Cap Table template with authorized shares. Then, show issued and outstanding by class. Begin with founders’ common. List the employee option pool with granted and remaining shares. Add each preferred series. Finish with a fully diluted summary. This makes your early equity structure easy to see.

Make columns for what decision-makers need: Holder, security type, certificate or ID, shares. Add percent ownership (outstanding) and percent ownership (fully diluted). Include vesting status, exercise price for options, cost basis, and notes. This setup turns your cap table into a trusted source. It also makes auditing simple.

Include practical line items. These are founders’ common with four-year vesting and a one-year cliff. Include key hires’ options with strike price and monthly vesting. Add Seed preferred with price per share and liquidation preference. Include SAFEs with cap, discount, and estimated shares for the next round. This detail keeps your equity structure clear.

Match totals with board approvals and your stock plan. Make sure outstanding plus reserves matches authorized. Or clearly show remaining authorized shares. When your cap table matches signed consents, audits are quicker. Diligence also stays easy.

Make standard reports: a dated cap table snapshot, simple waterfall estimates, and investor-ready PDFs with pie charts. Many teams use equity platforms like Carta, Pulley, or Shareworks for this. A good cap table means you can answer ownership questions fast. It helps keep the focus on growing your business.

Founders’ Equity: Splits, Roles, and Vesting Dynamics

Your cap table should build trust and aim for results. Begin with matching ownership to actual contributions. This protects the company with terms based on time and allows changes for new team members. A clean setup lets you act quickly when big investors come calling.

Aligning equity with contribution and commitment

Set the founder equity split by looking at their input, the risks they take, and their commitment time. Consider who came up with the idea, who is in charge of making the product, who pays for things, and who manages daily operations. Write down these roles, their decision-making powers, and how you'll measure their success.

To decide the split, think about what each person has already done, what they'll do in the future, and how hard they are to replace. Make sure you can adjust as roles change over time. Keeping clear records on who is responsible for what helps avoid conflict and supports growth.

Founder vesting schedules and cliffs

Usually, founder vesting takes four years, with a one-year cliff before any vesting starts, then vesting happens monthly. This rewards those who stay and protects the company in its early stages. Also, have a plan for buying back shares if a founder leaves early.

Be careful when setting up acceleration clauses. A single-trigger deals with ownership change. A double-trigger also includes being fired without a good reason after such a change. Make sure all details are clear in your agreements to keep everyone's interests aligned, especially during sell-off discussions.

Handling departures and reallocation of unvested shares

Make a plan for when founders leave before it happens. Unvested shares go back to the company or its equity pool. For vested shares, use your right to buy them back on agreed-upon terms to avoid issues with your cap table.

Use any returned equity to fill gaps in your team, make better hiring offers, or keep for a key hire. Ensure your agreements make sense together so there are no unexpe

Your capitalization table is more than just numbers. It helps your business grow, hire, and get funds. This guide shows how to create a Startup Cap Table. It focuses on clean data, wise equity sharing, and a structure that grows with you.

You'll figure out founder equity, make vesting clear, and create an option pool for hiring. You'll also work on SAFEs and notes. Plus, you'll make a future cap table and see how investor shares might change. The aim is a cap table that impresses investors and helps your team move forward.

The method is straightforward: use standard terms, easy templates, and actions you can take now. We use tips from Y Combinator, Sequoia Capital, and Carta. This keeps your table on track with leading practices. See your cap table as a dashboard that guides your decisions about offers, funding rounds, and who owns what.

Keep your records accurate and share updates openly. Make your brand stronger with a fitting name. Find premium domain names at Brandtune.com.

What a Cap Table Is and Why It Matters for Early-Stage Companies

Your cap table is super important for your business. It shows who owns what in your company. It's where all shares, options, and other items are clearly listed. Knowing startup equity basics helps you make quick decisions about hiring, fundraising, and planning.

Defining capitalization tables in plain language

Imagine your cap table as the main record of who owns parts of your company. It lists everything—names, types of shares, how many shares, and percentages of ownership. This includes common and preferred shares, options, and more.

This detail helps you understand your company's current state. It makes tracking changes after fundraising rounds easy. So, you can see your company's growth clearly.

How ownership visualization supports smarter decisions

Tools like Carta and Pulley show you possible changes in ownership with visuals. You can see risks and how different decisions affect your company. This helps you make smart choices about offers to new hires and planning your budget.

With these tools, you can easily compare different fundraising scenarios. They make talking with investors smoother. And they help you tell your company's story without confusion.

Common pitfalls from poorly maintained equity records

Small errors in cap tables can lead to big problems. Examples include forgotten board approvals or not updated records. This makes things slow and confusing during financial checks. It can also make your company look bad.

Keep your records accurate by centralizing and checking them often. Include everything in your summaries. This way, your decisions are always based on correct data.

Core Components of a Clean Cap Table

A clean cap table includes every holder, type of share, and term in one spot. It should have a simple layout. It organizes by clear equity classes and shows all shares on a fully diluted basis. It's vital to use the same fields: holder name, type of share, number of shares, date given, how they vest, buy price, value at start, approval date, and document links.

Founders’ common shares

Record all the common shares from the start. Include how they vest and any buy-back rights. Mark any special conditions like change of control or firing that speeds up vesting. This ensures ownership is correct from the start and for future investments.

Employee option pool and reserved shares

Define the option pool as shares set aside for new hires and advisors. Track its size as part of all shares, with details like grant dates and prices. Keep a plan to see when more shares are needed and how it changes ownership.

Preferred shares from external investors

List each round of preferred shares, covering details like buy price and values before and after investment. Also include special rights and how they can change into common shares.

Convertible instruments and their placeholders

Set up placeholders for SAFEs and convertible notes that turn into preferred shares later. Note important terms like valuation caps and interest rates. Include these in the all-shares view to accurately show ownership before new investments.

Startup Cap Table

Start your Startup Cap Table template with authorized shares. Then, show issued and outstanding by class. Begin with founders’ common. List the employee option pool with granted and remaining shares. Add each preferred series. Finish with a fully diluted summary. This makes your early equity structure easy to see.

Make columns for what decision-makers need: Holder, security type, certificate or ID, shares. Add percent ownership (outstanding) and percent ownership (fully diluted). Include vesting status, exercise price for options, cost basis, and notes. This setup turns your cap table into a trusted source. It also makes auditing simple.

Include practical line items. These are founders’ common with four-year vesting and a one-year cliff. Include key hires’ options with strike price and monthly vesting. Add Seed preferred with price per share and liquidation preference. Include SAFEs with cap, discount, and estimated shares for the next round. This detail keeps your equity structure clear.

Match totals with board approvals and your stock plan. Make sure outstanding plus reserves matches authorized. Or clearly show remaining authorized shares. When your cap table matches signed consents, audits are quicker. Diligence also stays easy.

Make standard reports: a dated cap table snapshot, simple waterfall estimates, and investor-ready PDFs with pie charts. Many teams use equity platforms like Carta, Pulley, or Shareworks for this. A good cap table means you can answer ownership questions fast. It helps keep the focus on growing your business.

Founders’ Equity: Splits, Roles, and Vesting Dynamics

Your cap table should build trust and aim for results. Begin with matching ownership to actual contributions. This protects the company with terms based on time and allows changes for new team members. A clean setup lets you act quickly when big investors come calling.

Aligning equity with contribution and commitment

Set the founder equity split by looking at their input, the risks they take, and their commitment time. Consider who came up with the idea, who is in charge of making the product, who pays for things, and who manages daily operations. Write down these roles, their decision-making powers, and how you'll measure their success.

To decide the split, think about what each person has already done, what they'll do in the future, and how hard they are to replace. Make sure you can adjust as roles change over time. Keeping clear records on who is responsible for what helps avoid conflict and supports growth.

Founder vesting schedules and cliffs

Usually, founder vesting takes four years, with a one-year cliff before any vesting starts, then vesting happens monthly. This rewards those who stay and protects the company in its early stages. Also, have a plan for buying back shares if a founder leaves early.

Be careful when setting up acceleration clauses. A single-trigger deals with ownership change. A double-trigger also includes being fired without a good reason after such a change. Make sure all details are clear in your agreements to keep everyone's interests aligned, especially during sell-off discussions.

Handling departures and reallocation of unvested shares

Make a plan for when founders leave before it happens. Unvested shares go back to the company or its equity pool. For vested shares, use your right to buy them back on agreed-upon terms to avoid issues with your cap table.

Use any returned equity to fill gaps in your team, make better hiring offers, or keep for a key hire. Ensure your agreements make sense together so there are no unexpe

Start Building Your Brand with Brandtune

Browse All Domains